Katherine Salisbury, Co-Founder of Qapital, on Using Psychology To Save Money

Katherine Salisbury is the co-founder and chief strategy officer at Qapital.

When Qapital co-founder Katherine Salisbury was starting her career, she didn’t set her sights on working in tech. In fact, she got her start in law, acting as a corporate lawyer for firms like White & Case and Jefferies Finance.

But as she and her husband (app co-founder George Friedman) tried to save money, they found that it didn’t come naturally. After honing their own savings skills, the two founded Qapital, a personal finance app that uses behavioral finance to encourage users to save their money.

Katherine spoke with She Spends about her own personal finance journey and what sets Qapital apart from other personal finance apps.

Editor’s note: this interview has been edited and condensed for clarity. As a heads up, this Q&A is not sponsored content. If we ever do post sponsored content, it will be made clear from the headline and throughout the story.

What sparked the idea for Qapital?

In my own life, I was finding that I could not do everything I wanted to do perfectly in a day. I was not being very frugal. Money was the one I was always letting go and it was driving my husband George crazy. One of the hacks that worked for us was to create bank accounts and name them. When we were doing something frugal, we would transfer money into a savings account specifically for a trip we wanted to take to Kenya. It was working for us. It was much easier to skip the taxi and take the subway when I was doing that.

Meanwhile, George and our other co-founder, Eric Akterin, were working for an e-trade company. They wanted to build something of their own. So we all got together in our living room on ample parental leave and started to build something. Their goal was to start with a version of Mint for Sweden. Eventually, it became a goal-based savings product for customers in the United States.

Your audience is mainly womxn. Why do you think that is?

We weren’t doing the user insights until later on when we had a large user base. We realized we were skewing 70 to 75 percent female. Most of the other fintech companies are the opposite.

My theory is that this is because we attack savings and the behavior of money as our primary product offering. We’re helping people at the moment of spending. Women do 80 percent of the spending in the United States. Women are taking on the role of CFO in their households and they’re making all these micro-financial decisions. It’s easier to organize those decisions when you have all your goals laid out.

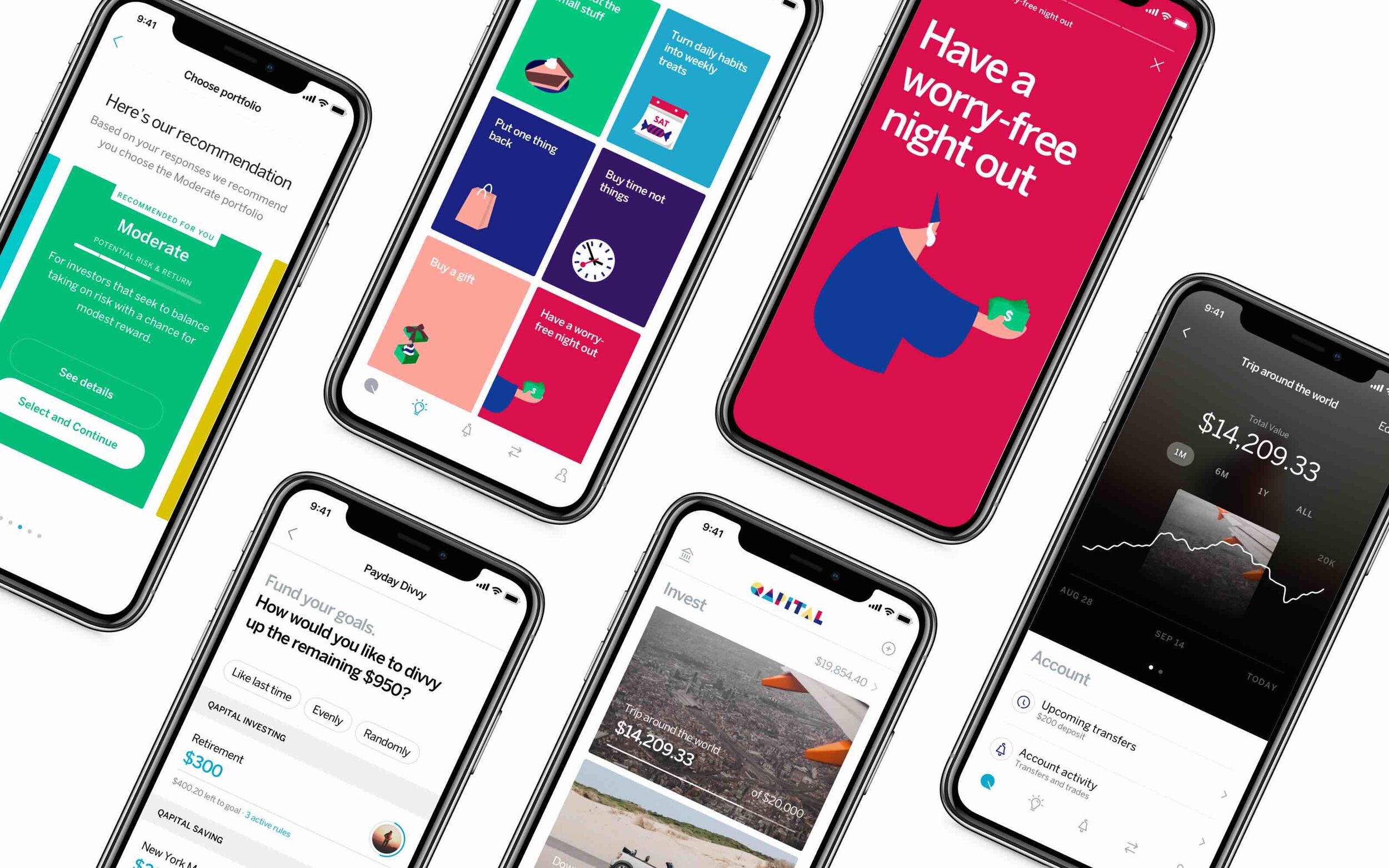

Qapital Missions encourage users to think critically about how their habits impact their spending, and ultimately their checking account.

What sets you apart from other finance apps?

I think what sets us apart is that we work with behavioral scientist Dan Ariely. He’s written a number of New York Times bestsellers like Predictably Irrational.

When it comes to creating a savings habit, you kind of have to find that special space of what’s always going to give you the dopamine reward to keep you coming back for more. So we worked with Dan on all of our product builds.

We start with the paycheck and try to automate as much as humanly possible. We don’t want you to be miserable now so you can retire later. We want you to weaponize your psychology before you start making decisions. We all have a limited pool of self-discipline.

You can the difference with our users. If they’re just using the savings goal piece, you have something like 13 app sessions per month. If we’ve gamified it correctly, you keep using it more and more. The average user saves $6,000 per year, and we have quite a span of income levels for our users. Those who are just using the savings goal app save about $1500 per year.

We started out very product-focused and naive and thinking about what we could build to build the world a better place, but then you get bogged down in what investors want. Our team is so great about being purists. At other times, it’s great to just have that compass constantly being pounded on.

Qapital allows users to integrate IFTTT, or If This Then That, a web-based service that allows users to set up rules. So, for example, someone can set up a rule in Qapital to save money every time they take an Uber. Can you tell me a little about that integration?

We just launched a bunch of new rules, which you can see on our website. Users with IFTTT Rules save almost double over a 30-day period than those without them. In dollar terms, IFTTT users save an average of $407 in a month while for non-users the figure is $235.

What rules are the most effective ones?

It’s a two-horse race for the most popular IFTTT Rule, with Fitbit just edging out Uber. It seems like users are taking rides a little more than working out, as Uber leads the way when it comes to the total number of actual savings events.

What has been inspiring you lately?

My greatest source of inspiration is my children. While it can be a lot to juggle, it’s incredible to have the privilege of raising humans with open eyes. To have three daughters and have the opportunity to teach them fearlessness at a young age is a huge motivation for me, each and every day.

What else should our readers know?

The one bit that has been new in my mind lately and I think has been so true is that the rate of savings is much more important than the rate of return for most people unless you’re quite wealthy. That act of consistently putting money away. It just seemed to be so true. I think that’s one of the pieces that people don’t talk about enough. It seems like the most important thing we can do for our users is to just squirrel away money. That seems to be the path to success.